Income Tax Reliefs In Malaysia

马来西亚所得税减免(Income Tax Reliefs In Malaysia)

大多数大马人选择 Private Retirement Scheme Malaysia(PRS 马来西亚私人退休金计划),最大的原因就是税务减免。通过 PRS,你每年可以申请高达 RM3,000 的个人税务减免,同时还在为退休做储蓄。更重要的是,通过降低你的应课税收入,PRS 不只帮你累积未来退休金,也能马上减少你现在需要缴交的税款。

税务减免与实例(Tax Reliefs & Examples)

如果你曾经买过一本书或一部智能手机,并在心里提醒自己隔年要申请税务减免,那么你其实已经知道税务减免是怎样运作的。

简单来说,税务减免就是帮你减少应课税收入。而你的应课税收入会直接决定你属于哪一个税阶,这也会直接影响你最后要交多少税。

👉 例如:

假设你的年度应课税收入是 RM40,000。在这个水平,你通常需要缴纳 RM900(税率 6%)。

但是,如果你再多申请 RM11,600 的税务减免,你的应课税收入就会降低到 RM28,400。

因此,你的税阶会下降到 3%。除此之外,你还符合条件获得 RM400 的额外退税(适用于年收入 RM35,000 以下)。

最后,你真正需要缴交的税款只剩下 RM2 —— 也就是说,你一共省下了 RM898!

目前,大马政府一共提供20 种不同的所得税减免。所以,务必要确认自己符合哪些条件,才能把节税的空间用到最大。

如何最大化你的退税?(How to Maximise Your Income Tax Refund in Malaysia)

归根结底,税务减免和退税就是帮你减少纳税负担的工具。大多数大马人其实已经透过 MTD(每月自动扣税) 预缴了一整年的税款。

所以,如果你善用税务减免,通常你在报税时就可以拿到更大的退税额。

👉 道理很简单:你被征收的税越少,你从政府那里拿回来的退税就越多。而更多的退税,就等于更多的现金回到你口袋里。

📌 小贴士:当 2024 年 3 月 1 日开放申报 2023 课税年度(YA2023)的报税时,记得提早准备,确认自己可以申请哪些减免。这样,你就能最大化退税,同时避免临时报税的压力。

PRS Malaysia 税务减免高达 RM3,000

为退休做储蓄的同时,还能马上省税 —— 这就是 PRS Tax Relief 的好处。无论你是第一次开户,还是要为现有 PRS 账户加码,每年都能享有高达 RM3,000 的税务减免。

👉 LHDN(马来西亚内陆税收局)允许所有 PRS 投资者申请这项税务减免,直到 2030 年课税年度。

你到底能省多少税?(How Much Tax Can You Actually Save?)

以下的表格简单说明,如果你每年投入 RM3,000 在 PRS 账户里,可以省下多少税:

例如:如果你的税阶是 25%,那么这 RM3,000 的投入,就能让你省下 RM750 的税款。

📌 注意:这个表格只是一个参考,实际的税务计算请向持牌的税务代理确认。

💡 “Tax Relief = 少交税 + 多存钱 = 双赢”

3 分钟快速知道你的退税!(Tax Planning – Find Out in Just 3 Minutes!)

想要马上知道你可能的退税额吗?试试我们的 Tax Payable Simulator(税务模拟计算器):

- 输入你的年薪、租金收入或其他收入。

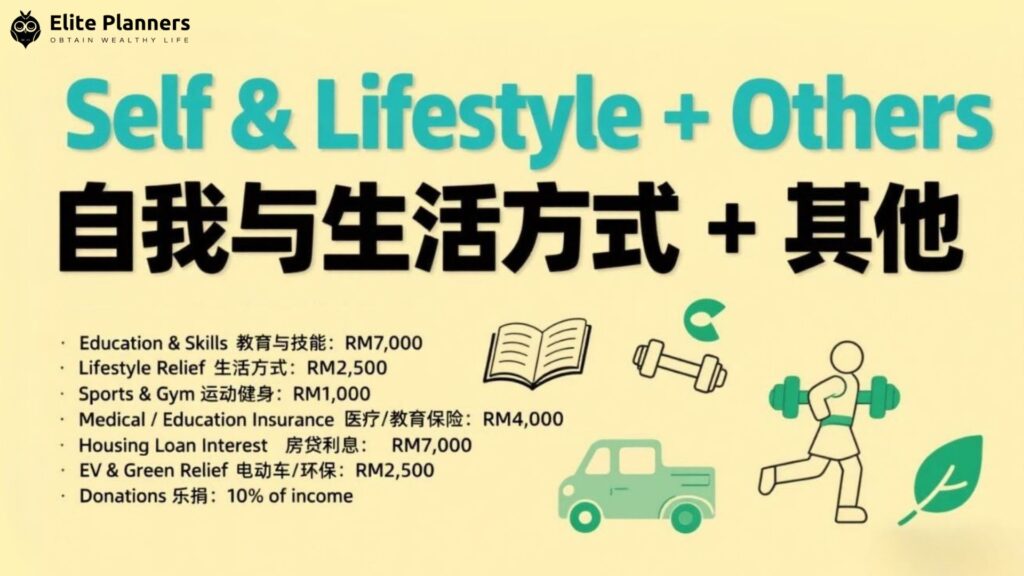

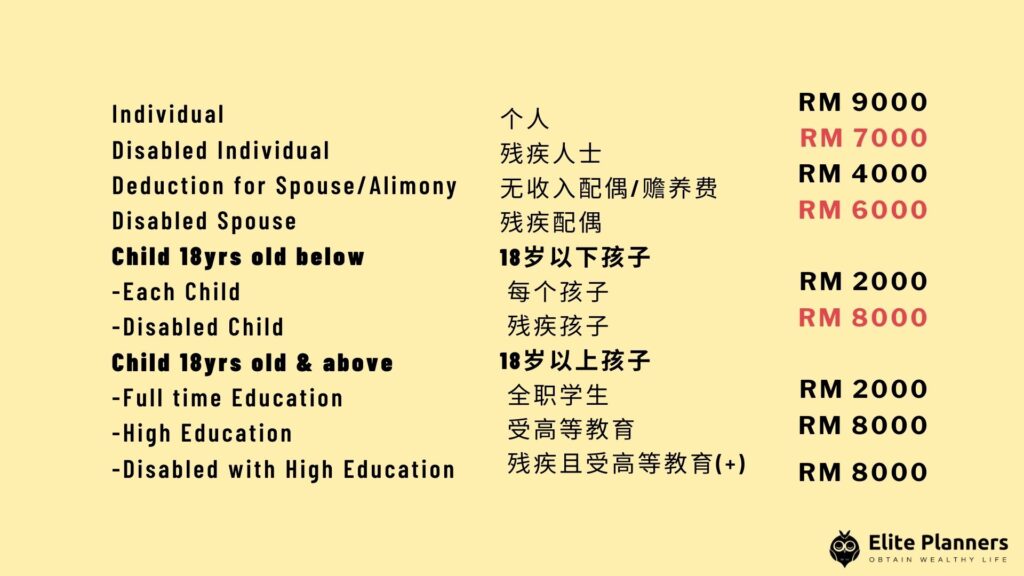

- 再输入所有符合条件的减免,例如:个人扣除额、配偶、孩子教育费、医疗费、PRS、保险、生活方式消费等等。

- 计算器会立即显示你的应课税收入、税阶,以及预计的退税。

💡 记住:更多的税务减免 = 更低的应课税收入 = 更大的退税。

有时,还能直接把你推到更低的税阶!

下一步行动(Take Action Now)

- ✔ 立即开户或加码你的 PRS 账户

- ✔ 每年申报高达 RM3,000 的 PRS 税务减免

- ✔ 提前做好税务规划,把更多的钱留在自己口袋里

One of the biggest reasons Malaysians choose the Private Retirement Scheme Malaysia is the tax relief. With PRS, you can claim up to RM3,000 in personal tax relief every year while saving for retirement. Moreover, by reducing your chargeable income, PRS not only grows your future savings but also lowers the tax you pay today.

Tax Reliefs & Examples

If you’ve ever bought a book or a smartphone and later reminded yourself to claim it for tax relief, you already understand how tax reliefs work. In short, tax reliefs reduce your chargeable income. As a result, your income tax bracket changes, which directly affects how much tax you must pay.

👉 For example:

Let’s say your annual chargeable income is RM40,000. Normally, you would pay RM900 in tax at the 6% rate. However, if you claim an extra RM11,600 in reliefs, your chargeable income drops to RM28,400. Therefore, your tax bracket falls to 3%. On top of that, you qualify for an additional RM400 rebate (for incomes up to RM35,000). In the end, your total payable tax is only RM2 — giving you savings of RM898!

The Malaysian government currently offers 20 types of income tax reliefs. Because of this, it is crucial to check which ones you qualify for to maximise your savings.

How to Maximise Your Income Tax Refund in Malaysia

At the end of the day, tax reliefs and rebates are simple tools to reduce your tax bill. Most Malaysians already pay monthly deductions (MTDs). Therefore, using reliefs means you can often enjoy a bigger refund.

👉 The less tax you are charged, the more money you’ll get back from the government. And naturally, more refund means more cash in your pocket.

📌 Pro tip: When tax filing for YA 2024 opens on 1 March 2025, prepare early and know which reliefs you can claim. This way, you can maximise your refund and avoid last-minute stress.

👉 Click the yellow button below to unlock the full explanation.

Private Retirement Scheme Malaysia Tax Relief – Up to RM3,000

Saving for retirement with Private Retirement Scheme Malaysia does not just prepare you for the future — it also reduces your tax today. With PRS Tax Relief, you can claim up to RM3,000 each year.

👉 Whether you are opening your PRS account for the first time or topping up an existing one, this annual tax incentive is a smart way to grow retirement savings while cutting your taxes.

The Inland Revenue Board of Malaysia (LHDN) allows every PRS contributor to claim this personal tax relief until YA 2030.

How Much Tax Can You Actually Save?

This simple table shows the potential tax savings from contributing RM3,000 annually into your PRS account. For example, if your tax bracket is 25%, a contribution of RM3,000 translates into RM750 in tax savings. As a result, you not only prepare for retirement but also save money instantly.

📌 Note: This table is only a guide. Always confirm the exact calculation with your licensed tax agent.

Estimated Tax Savings Table: The above table serves as a guide only. You should contact your tax agent should you wish to know the exact amount of tax savings from your contribution to PRS.

Tax Planning – Find Out in Just 3 Minutes!

Want to know your potential refund quickly? Try our Tax Payable Simulator below.

Tax Planning

Private Retirement Scheme Malaysia – Tax Planning for Current Year

Plan before year-end to minimise your tax payment and maximise your refund.

- Input your annual salary, rental income, and other sources of income.

- Enter allowable reliefs such as personal deduction, spouse deduction, children’s education, medical expenses, PRS contributions, insurance, and lifestyle expenses.

- The calculator will instantly show your estimated chargeable income, tax bracket, and potential refund.

💡 More tax relief = lower taxable income = bigger refund.

And sometimes, the right reliefs may even push you down into a lower tax bracket altogether!

Take Action Now

✔ Enroll or top up your PRS account today.

✔ Claim up to RM3,000 PRS tax relief in Malaysia annually.

✔ Start proper tax planning to keep more money in your pocket.