私人退休金计划 Malaysia(Private Retirement Scheme, PRS)

PRS 是一项自愿性长期储蓄与投资计划,帮助大马人累积更多退休储备金。无论是受雇人士或自雇人士,都可以通过 PRS 在一个安全且受监管的环境下,补足公积金(EPF)以外的退休储蓄。

为什么要额外储蓄退休金?

研究显示,你在退休时至少需要 最后薪水的 67% 才能维持现有生活水准。

- PPA 建议你至少储蓄月薪的 三分之一 (33%)。

- 私人领域中,你已自动贡献 11%,雇主再加 12%,合计 23% 存入 EPF。

- 因此,只需额外存入 10% 薪资到 PRS,就能达到退休目标。

PRS 的优势

- 专为退休而设:帮助你储蓄更多退休金。

- 灵活有弹性:可从 8 家 PRS 基金管理公司,以及多种(传统或伊斯兰教义)基金中选择。

- 免费提名受益人:保障你的亲人。

- 可负担:最低 RM1,000 即可开户并开始储蓄。

- 债权人保护:PRS 资产独立,不受基金管理公司债务影响。

- 免费意外保险:会员享有额外 PA 意外保险保障。

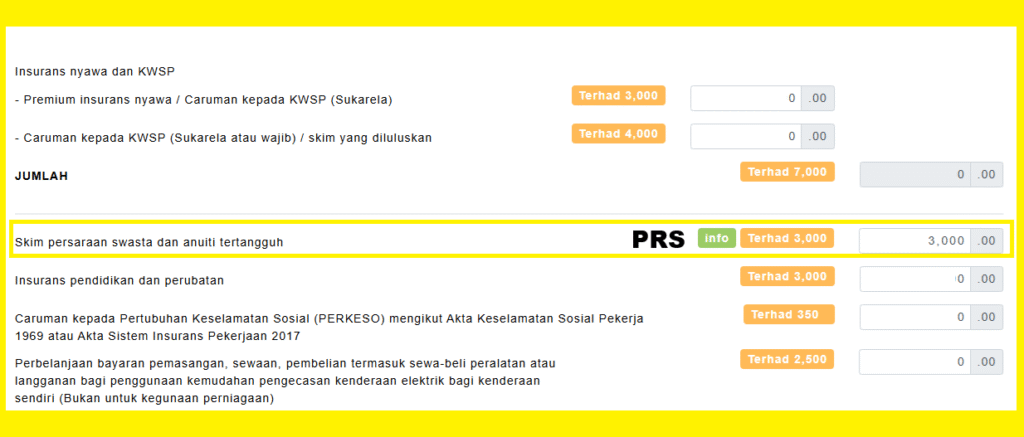

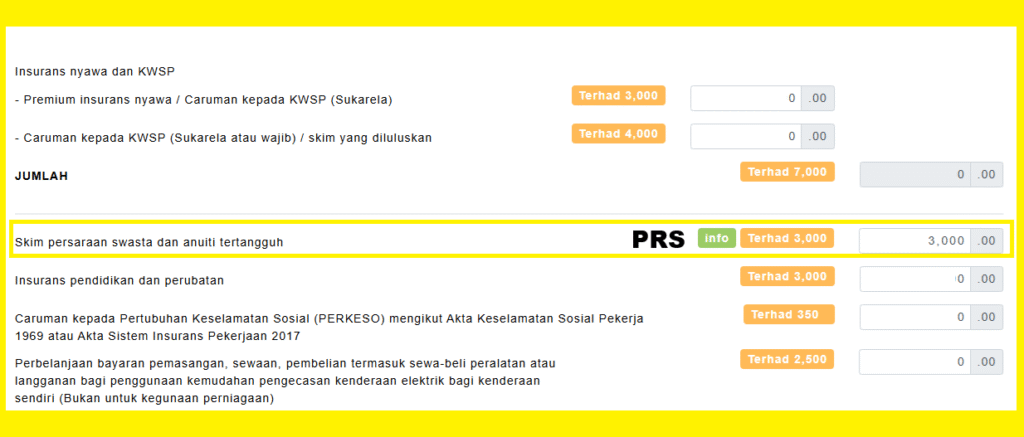

- 税务减免:每年可享最高 RM3,000 的个人税务减免。

PRS 如何运作?

你的存款会分为两个子账户:

- 70% 子账户 A:只能在 55 岁退休、死亡或永久离开大马时提取。

- 30% 子账户 B:每年可提取一次(受条规限制)。

💡 PRS 不只是储蓄退休金,同时也能帮你每年节省税务,让你 “一边省税,一边存未来”。

下一步

- 使用 PRS,享受每年最高 RM3,000 的税务减免。

- 结合 EPF 与 PRS,打造更强大的退休储备。

- 资讯 顾问了解私人定制的退休配套。

What is Private Retirement Scheme (PRS) Malaysia?

Private Retirement Scheme Malaysia (PRS) is a voluntary savings plan that helps Malaysians build a secure retirement. With PRS, you can enjoy professional fund management, flexible contribution options, and valuable tax incentives. Whether you are employed or self-employed, the Private Retirement Scheme Malaysia provides a regulated and reliable way to supplement your EPF savings.

In addition, PRS provides more choices for all Malaysians, whether you are employed or self-employed, to supplement your EPF savings. In addition, you can select from a range of PRS funds offered by 8 PRS Providers, so that your plan matches your retirement goals, investment preferences, and risk appetite.. As a result, you can invest for higher potential returns in a safe and regulated environment. At the same time, you also enjoy annual tax relief benefits of up to RM3,000.

👉 In short, PRS allows you to invest for higher potential returns in a safe and regulated environment. At the same time, you enjoy tax relief benefits of up to RM3,000 per year.

Why Should I Save More for Retirement?

Studies suggest you will need at least two-thirds (67%) of your last drawn income to maintain your lifestyle after retirement.

To achieve this benchmark:

- PPA recommends saving at least one-third (33%) of your monthly salary.

- In the private sector, employees already contribute 11% while employers add 12%, bringing the total to 23%.

- Therefore, you only need to save an extra 10% of your salary in PRS to reach the retirement target.

👉 With PRS, you not only save more for retirement but also enjoy immediate personal tax savings every year.

Private Retirement Scheme Malaysia Benefits

How PRS Malaysia Works

Your contributions are divided into two sub-accounts:

PRS ACCOUNT

*1Note: Full withdrawal is allowed upon reaching age 55, or as specified by the Securities Commission Malaysia.

*2Subject to terms and conditions.

PRS Performance, Fees & Calculator

Check PRS fund performance to select the most suitable funds.

Try our Retirement Calculator to estimate how much you need for retirement.

Understand the fees and charges before investing.

One of the biggest attractions of PRS is the tax relief. By contributing to PRS, you can claim up to RM3,000 tax relief every year under individual tax assessment.

👉 This means you save on taxes today while building wealth for tomorrow.

Enroll or Top Up your PRS here now!

Next Steps

💡 If you want to maximise your retirement planning:

- Use PRS to enjoy annual tax relief + retirement savings growth

- Combine PRS with EPF for a stronger retirement fund

- Try our free Malaysia Retirement Calculator (Excel) to check your savings gap