Looking for the latest Malaysia Tax Relief YA 2025 updates?

This guide covers the full list of reliefs, caps and sub-limits, including key differences compared to YA 2024. From EPF and PRS to medical, parents, lifestyle and housing, here’s everything you need to know to maximize your tax savings.

点击这里查看中文版 ▼

马来西亚个人所得税减免 YA 2025 完整指南(含 YA 2024 对比)

想了解 Malaysia Tax Relief YA 2025 的最新变化吗?本指南汇总所有减免、总额与子限额,并标注 YA 2024 与 YA 2025 的关键差异,涵盖 EPF、PRS、医疗、父母、生活方式、教育与房屋贷款,帮助你最大化节税空间。

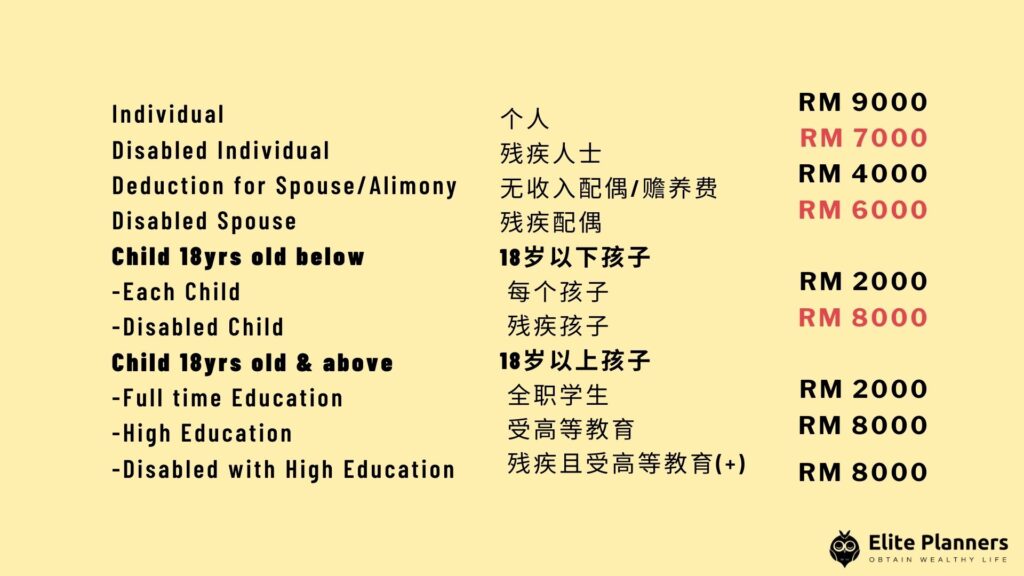

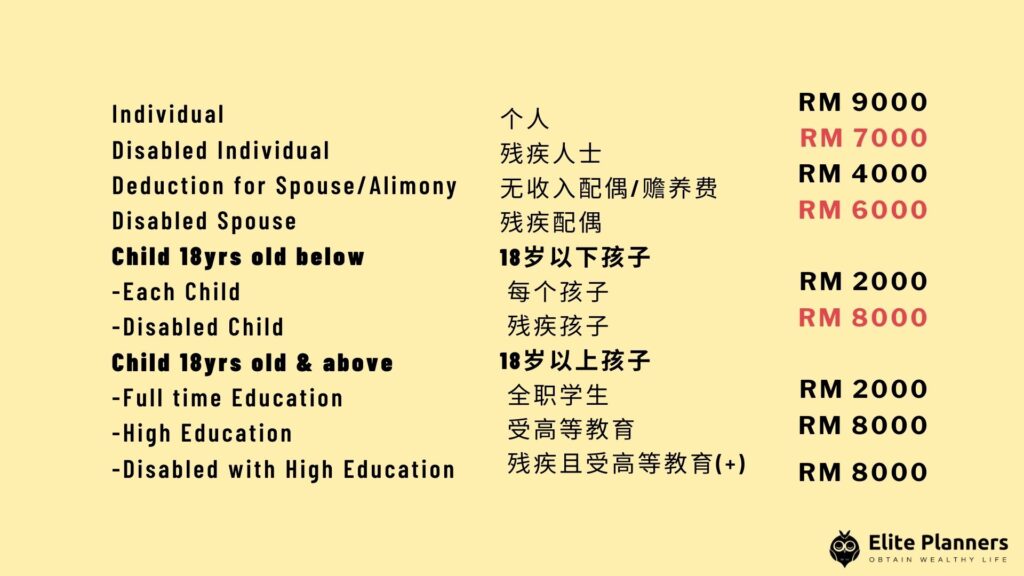

✅ 个人基本减免

- 自己:RM9,000

- 残障纳税人:RM6,000(YA 2025 起 RM7,000)

- 配偶:RM4,000

- 残障配偶:RM5,000(YA 2025 起 RM6,000)

👶 子女减免

- 18 岁以下未婚子女:RM2,000

- 18 岁以上(全日制大专/大学或在马来西亚进行专业实习):RM8,000

- 残障子女(未婚):RM6,000(YA 2025 起 RM8,000)

- 残障子女(18 岁以上修读高等教育):额外 RM8,000

💼 退休、保险与 EPF

- 人寿保险保费 / 自愿 EPF 供款:RM3,000

- 强制与自愿 EPF 供款(含公务员养老金计划):RM4,000

- 私人退休基金(PRS)与年金:RM3,000(延长至 YA 2030)

- 教育或医疗保险:RM3,000(YA 2025 起 RM4,000)

- SOCSO / PERKESO:RM350

🏥 医疗与健康开销(总额上限 RM10,000)

适用于本人、配偶或子女;以下均为 RM10,000 总额 内的子限额:

- 严重疾病医疗费;生育治疗(本人/配偶)

- 疫苗接种:上限 RM1,000;全面体检:上限 RM1,000

- 新冠检测(含自测包);心理健康检查/咨询:上限 RM1,000

- 学习障碍儿童(<18 岁):诊断/早期干预/康复 上限 RM4,000(YA 2025 起 RM6,000)

- 牙科检查/治疗(注册牙医):上限 RM1,000

YA 2025 扩展:自测医疗设备(血糖仪、血压计、体温计等);疾病筛查(抽血、超声波、乳房 X 光、子宫颈抹片等)。

👵 父母与祖父母(总额上限 RM8,000)

YA 2025 起扩展至祖父母;RM8,000 为总额上限,包含:

- 医疗治疗与牙科治疗

- 疫苗接种:子限额 RM1,000;健康检查:子限额 RM1,000

- 特殊护理或看护费用(需医生证明)

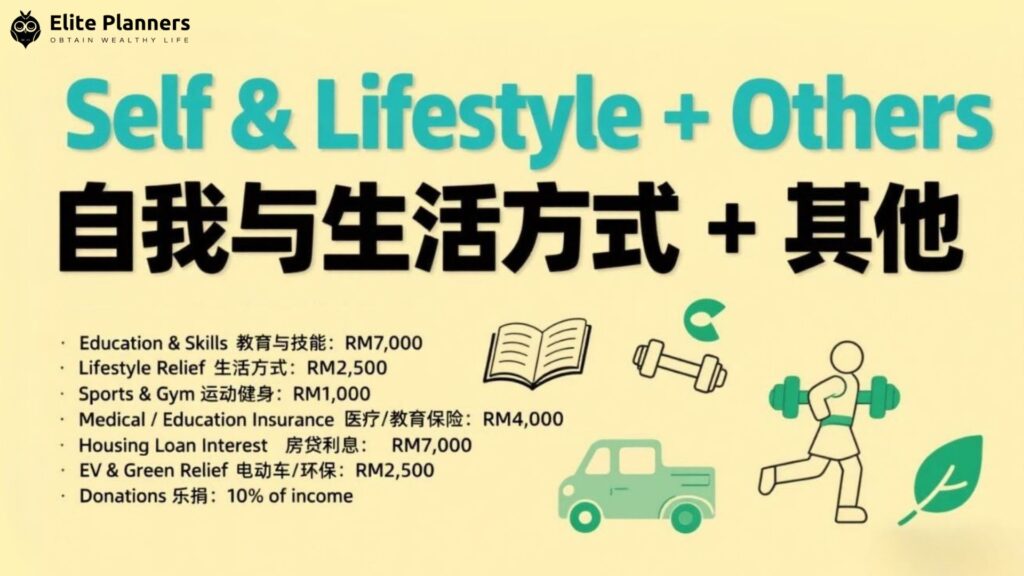

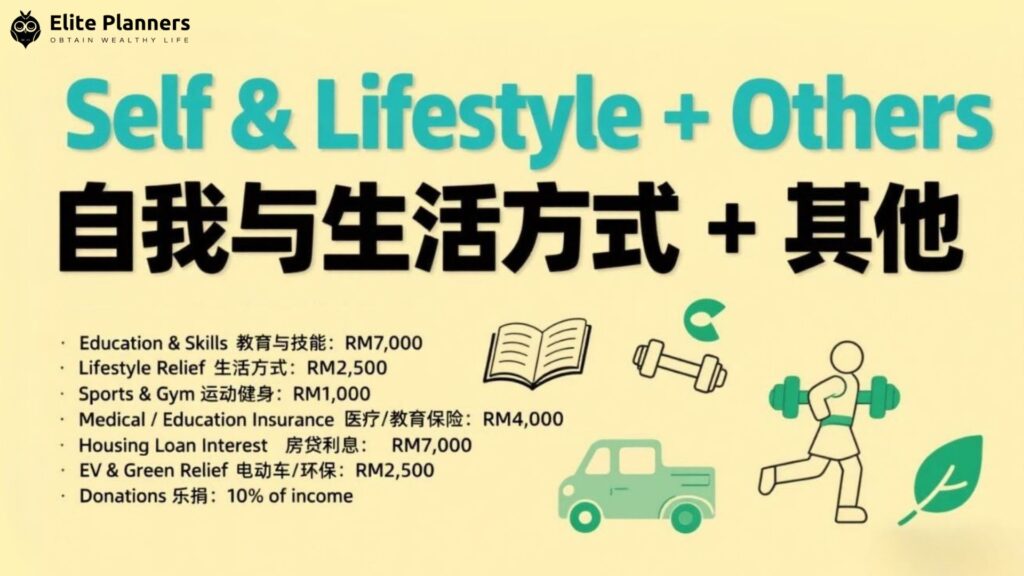

🎓 教育与技能培训(总额上限 RM7,000)

- 认可资格课程(法律、会计、伊斯兰金融、技术、工艺、工业、科学、科技):最高 RM7,000

- 硕士/博士课程:包含在 RM7,000 内

- 技能提升/自我增值课程(技能发展局认可):子限额 RM2,000(至 YA 2026;计入 RM7,000 总额)

🛍️ 生活方式与家庭

生活方式减免(总额 RM2,500) 包含:书籍/杂志(纸本与电子)、电脑/手机/平板、上网费用、自我增值课程。

- 哺乳设备:RM1,000(每 2 年一次)

- 托儿所与幼儿园学费:RM3,000(延长至 YA 2027)

- SSPN 储蓄:RM8,000(延长至 YA 2027,父母任一人可申报)

- 体育与运动:RM1,000(器材、场地费、健身房会员、注册教练培训;YA 2025 起扩展至父母)

🌱 环保与房屋

- 电动车充电设施/订阅费:RM2,500;YA 2025 扩展:家用厨余处理机(至 YA 2027)

房屋贷款利息(首 3 个连续课税年):

- RM500,000 及以下:RM7,000

- RM500,000–RM750,000:RM5,000

- 须在 2025/01/01 — 2027/12/31 签署买卖合约(SPA)

📌 YA 2025 重点总结

- 残障个人/配偶减免增加;残障子女减免提升

- 父母减免扩展至祖父母(总额 RM8,000 不变)

- 医疗范围扩展:新增自测设备与多项诊断检查

- 学习障碍儿童治疗减免提升至 RM6,000

- 教育/医疗保险减免提高至 RM4,000

- 体育减免涵盖父母;托儿与 SSPN 延长至 YA 2027

- 环保减免新增厨余处理机(至 YA 2027)

📊 计算你的马来西亚税务减免 YA 2025

想知道在 Malaysia Tax Relief YA 2025 下你能省多少税?👉 立即试用我们的 免费税务计算器。

若想透过 PRS 私人退休基金 进一步增加减免,欢迎 联系顾问,为你制定一对一专属方案。

✅ Core Personal Reliefs

- Self: RM9,000

- Disabled individual (self): RM6,000 (RM7,000 w.e.f YA 2025)

- Spouse: RM4,000

- Disabled spouse: RM5,000 (RM6,000 w.e.f YA 2025)

👶 Child Relief

- Unmarried child below 18 years: RM2,000

- Child over 18 years (full-time diploma/degree or professional articles in Malaysia): RM8,000

- Disabled child (unmarried): RM6,000 (RM8,000 w.e.f YA 2025)

- Disabled child over 18 in higher education: Additional RM8,000

💼 Retirement, Insurance & EPF

- Life insurance premiums / Voluntary EPF contributions: RM3,000

- Obligatory & Voluntary EPF contributions (including pension scheme contributions for public servants): RM4,000

- Private Retirement Scheme (PRS) & Deferred Annuity: RM3,000 (extended to YA 2030)

- Insurance premiums for education or medical benefits: RM3,000 (RM4,000 w.e.f YA 2025)

- SOCSO contributions: RM350

🏥 Medical & Health Expenses (Total cap RM10,000)

Applicable for self, spouse, or child. The following are sub-limits within RM10,000:

- Serious diseases medical expenses

- Fertility treatment (self/spouse)

- Vaccination – up to RM1,000

- Full medical examination – up to RM1,000

- COVID-19 detection test (including self-test kits)

- Mental health examinations/consultations – up to RM1,000

- Learning disability (child <18): diagnostic assessment / early intervention / rehabilitation – up to RM4,000 (raised to RM6,000 w.e.f YA 2025)

- Dental examination/treatment (by registered dentist) – up to RM1,000

YA 2025 expansion:

- Self-testing medical devices (e.g. glucometer, blood pressure monitor, thermometer)

- Disease detection exams (e.g. blood test, ultrasound, mammogram, pap smear)

👵 Parents & Grandparents (Total cap RM8,000)

Covers expenses for parents’ medical/dental needs (extended to grandparents w.e.f YA 2025).

Included within RM8,000 cap:

- Medical treatment

- Dental treatment

- Vaccination – sub-limit RM1,000

- Medical check-up – sub-limit RM1,000

- Special needs or carer expenses (with medical certification)

🎓 Education & Skills (Total cap RM7,000)

- Course fees for approved qualifications:

- Legal, accounting, Islamic finance

- Technical, vocational, industrial, scientific, technological fields

- Master’s / Doctorate degree courses:

- Any qualification/skill (Malaysia or abroad)

- Upskilling / Self-enhancement courses:

- Recognised by Director General of Skills Development

- Sub-limit RM2,000 (until YA 2026)

- ⚠️ Included under the RM7,000 cap (not additional)

🛍️ Lifestyle & Family

- Lifestyle relief (Total cap RM2,500) includes:

- Books, journals, magazines, newspapers (print/electronic)

- Purchase of personal computer, smartphone, tablet

- Internet subscription

- Self-enhancement/upskilling courses

Other family-related reliefs:

- Breastfeeding equipment: RM1,000 (once every 2 YAs)

- Childcare & kindergarten fees: RM3,000 (extended to YA 2027)

- SSPN (Skim Simpanan Pendidikan Nasional) deposits: RM8,000 (extended to YA 2027, claimable by either parent)

- Sports equipment & activities: RM1,000 including:

- Sports equipment purchases

- Entry/rental fees for sports facilities

- Gym membership fees

- Training fees by registered clubs/companies

- YA 2025 extension: now includes parents

🌱 Green & Housing

- EV charging facilities / subscription fees: RM2,500

- YA 2025 expansion: also covers household food waste composting machine (until YA 2027)

- Housing loan interest (first 3 consecutive YAs):

- Property ≤ RM500,000 → RM7,000

- Property RM500,000 – RM750,000 → RM5,000

- (Valid for SPA signed 1 Jan 2025 – 31 Dec 2027)

📌 Key Takeaways for YA 2025

- Disabled individual & spouse relief increased

- Child disability relief increased

- Parents’ relief expanded to grandparents (still RM8,000 cap)

- Medical relief scope expanded: includes self-test devices & diagnostic exams

- Learning disability relief raised to RM6,000 (sub-limit)

- Education/medical insurance relief increased to RM4,000

- Sports relief now covers parents

- Childcare & SSPN extended to YA 2027

- Green relief expanded to include food waste composting machines

📊 Calculate Your Malaysia Tax Relief YA 2025

Want to know how much you can save under Malaysia Tax Relief YA 2025?

👉 Use our Free Tax Calculator to estimate your savings instantly.

If you’d like to explore PRS (Private Retirement Scheme) contributions for even more tax benefits, feel free to contact our consultant for a one-to-one personalized plan.