How much money do you actually need to retire comfortably in Malaysia? Many people use a retirement calculator Malaysia to estimate whether RM1 million, RM2 million, or even more is enough.

在马来西亚,退休到底需要多少钱?

很多人常问:在马来西亚,要准备多少才够退休?RM100万?RM200万?还是更多? 其实,很多人会用 马来西亚退休计算器 (retirement calculator Malaysia) 来先做个估算,看看自己现有的储蓄能不能撑到退休后的生活。

你的退休生活方式

简单来说,退休后你的生活开销会变少吗?如果会,那就是「低于平均」的生活方式。 如果打算花费跟现在差不多,那就是「平均」。 如果你想花得更多,那就是「高于平均」的生活水平。

退休要准备多少才够?

到底要存多少钱,才能安心过完「黄金岁月」? 答案因人而异,取决于你的生活方式和消费习惯。 但你也可以参考一些简单的原则,作为起点。

在马来西亚,人均退休后的平均寿命大约是 20 年,所以越早规划越安心。

收入替代率法 (Income Replacement Ratio Method)

CFP® 认证财务规划师的建议是:你需要替代最后薪水的 75% – 85%,才能维持退休前的生活水准。

例如:如果你现在的年收入是 RM100,000,那么退休后每年大约需要 RM80,000。

👉 你可以用下面的 收入替代率计算器 来测算。

调整开销法 (Adjusted Expenses Method)

用现在的生活开销为基础,加上通货膨胀率,推算到退休年龄,就能大概知道需要多少钱。

举例:

- 食物:价格会随着通胀上涨

- 交通:退休后可能减少

- 房贷:如果在退休前还清,支出会减少

- 医疗:随着年纪增长,开销会增加

👉 最简单的方法:直接联络我们的顾问团队,或用下面的 调整开销计算器 来试算。

免费领取马来西亚退休计算器 (Excel)

💡 想知道自己真正需要多少退休金吗? 👉 填写资料,我们会把 马来西亚退休计算器 (Excel) 发送到你的 Email 或 WhatsApp。

- 帮你快速估算退休需求

- 对比现有储蓄差距

- 找出退休缺口,提早补足

How You Want to Live in Retirement

In other words, when you retire, do you expect your expenses to go down? If yes, then you’ll be living a below-average lifestyle. In fact, many Malaysians reduce spending in retirement this way. On the other hand, if you plan to spend about the same as today, that’s considered average. However, if you expect to spend more, that’s an above-average lifestyle.

How Much Is Enough for Retirement?

So, how do you know how much money is enough to last through your golden years? The answer is personal, since it depends on your lifestyle and spending habits. However, there are also a few simple guidelines you can follow. In addition, these rules are easy for anyone to apply. Therefore, if you want to retire comfortably, you can use these rules as a starting point.

Now let’s determine how much savings you’ll need. First, figure out how much income you’ll need to generate from your savings. After that, the next step is to calculate how large your retirement nest egg must be in order to produce this income in perpetuity.

In Malaysia, people live an average of 20 years after retirement. As a result, planning early is essential to make sure your savings last long enough.

2 Simple Methods Beyond a Retirement Calculator Malaysia

1. Income Replacement Ratio Method

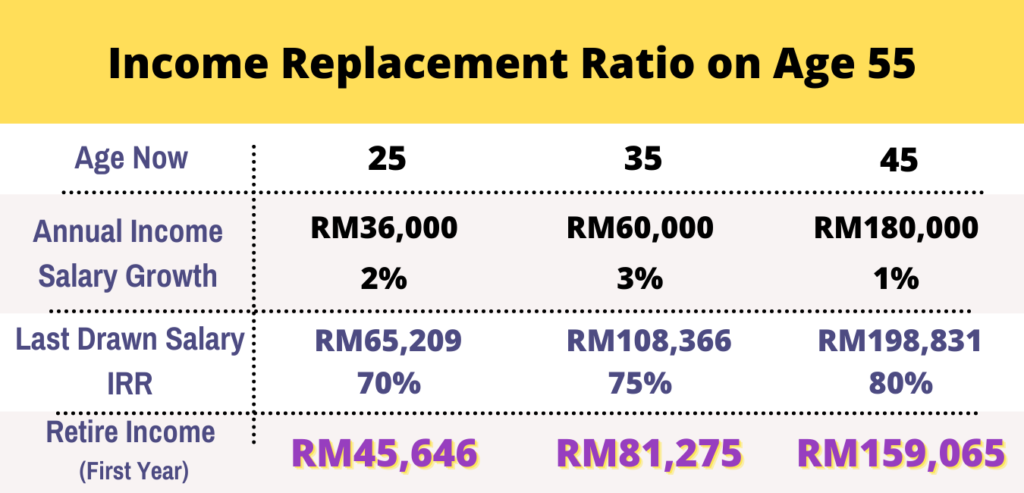

Estimate your retirement income. A common guideline used by CFP® Professionals is that you’ll need to replace 75% to 85% of your last drawn salary to maintain the same lifestyle and live comfortably in retirement.

In other words, if you earn RM100,000 now, you’ll need about RM80,000 per year (in today’s Ringgit) after you retire.

Example: Replacement Income Ratio – First Year of Retirement

To calculate your replacement rate, you’ll need to find out how much you’re likely to receive from your various sources of retirement income.

To calculate your replacement rate, as it’s called, you’ll need to find out how much you’re likely to receive from your various sources of retirement income.

👉 Use the Income Replacement Calculator below to get your estimate.

2. Adjusted Expenses Method

Estimate your retirement expenses (in today’s Ringgit). With this method, you can use your current expenses and compound them yearly to retirement age with an appropriate inflation rate.

This requires you to examine your spending habits carefully. Certain expenses may increase, some decrease, while others will vary as you grow older.

For example, food costs will likely rise as prices increase. Meanwhile, your transport costs may drop after you stop commuting. On the other hand, your transportation costs could decrease since you won’t be commuting to and from work. If you pay off your mortgage before retiring, housing costs will go down as well. However, healthcare costs are likely to increase during retirement.

Therefore, it is important to review your expenses both before and during retirement. A clear understanding of your anticipated retirement expenses is the first step to figuring out how much income you’ll need.

👉 The simple way: contact our consultant team to get a quick idea of how much you need to save for your desired lifestyle, or click the Adjusted Expenses Calculator below.

✅ Get Your Free Malaysia Retirement Calculator (Excel)

💡 Want to know your exact retirement number? Fill in your details below, and we’ll send you our Free Malaysia Retirement Calculator (Excel) directly to your email or WhatsApp.

Our Excel tool is designed specifically for Retirement Planning Malaysia, following CFP standards:

- Estimate your retirement needs

- Compare against your current savings

- Identify and close your retirement gap

With a retirement calculator Malaysia, you can check your savings gap instantly.