Retirement Planning Malaysia is about starting early. The earlier you begin, the easier it becomes to reach your goals. This is thanks to compounding.

1. Why Start Retirement Savings Early?

马来西亚退休规划指南 – 您需要多少钱才能退休?

越早开始储蓄退休金,就越容易实现目标。这是因为复利的力量。投资后,您的钱会产生收益,如果继续把收益再投资,时间越长,财富就能快速增长,远超本金。

1. 为什么要早点开始退休储蓄?

越早开始,未来需要储蓄的比例就越小。反之,拖延储蓄,未来要付出的压力会更大。

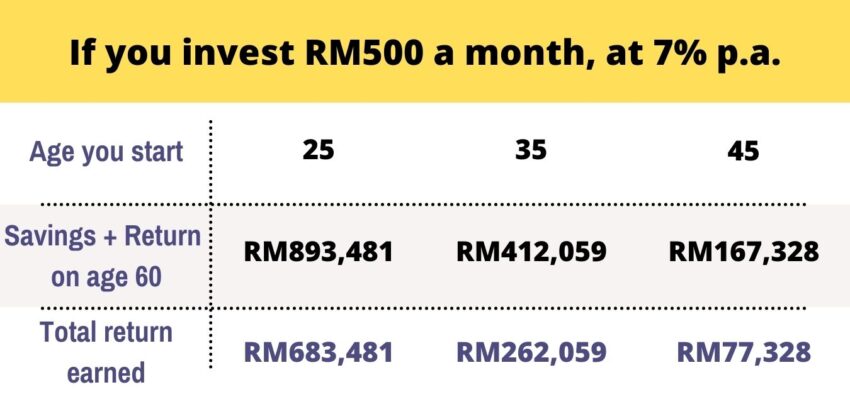

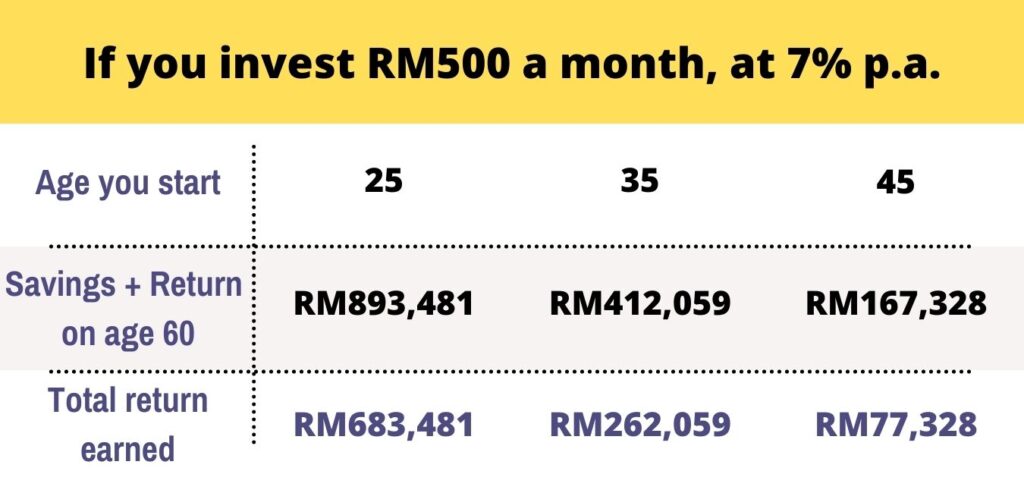

1.2. 提早开始 vs. 延迟 10 年的差别

- 25 岁开始:本金 RM210,000 → 增长到 RM683,481

- 35 岁开始:本金 RM210,000 → 仅增长到 RM262,059

- 45 岁开始:本金 RM90,000 → 仅剩 RM77,328

👉 相差 10 年,差别高达 RM420,000!

1.2. 复利如何让您的资金成长

如果 25 岁就开始投资 RM210,000,本金可增长到 RM683,481。 但若等到 35 岁才开始,同样的本金只增长到 RM262,059。 延迟就是损失复利的威力。

2. 您需要多少退休金?

一般指南:退休收入应为最后薪水的 70%–80%。 例如:最后年薪 RM100,000 → 退休后应准备 RM70,000–RM80,000/年。

👉 想要更精准的计算?请参考 如何计算退休所需金额。

3. 使用退休计算器

我们的 马来西亚退休计算器 (Excel) 遵循 CFP Malaysia 标准,您可以输入:

- 年龄、收入、现有储蓄、每月存款

- 计算退休基金未来增长

- 预测资金能支撑多久

- 是否存在缺口,以及如何填补

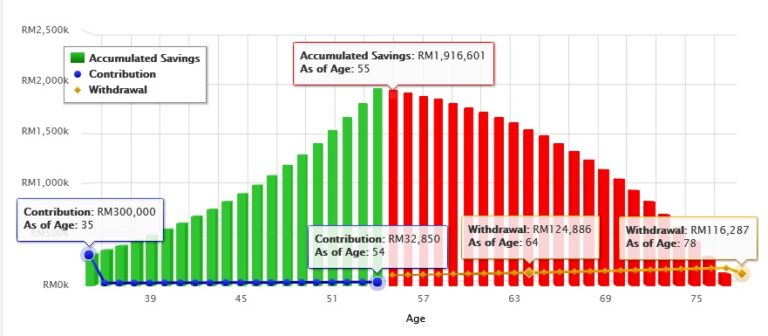

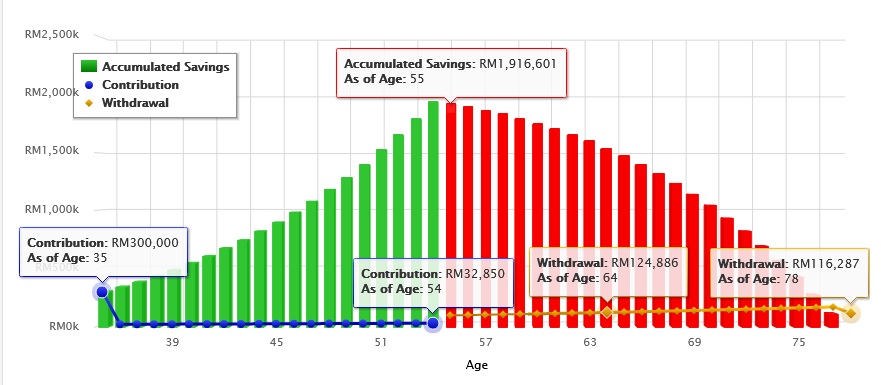

3.1. 案例:35 岁马来西亚女性

- 预期寿命:88 岁

- 年收入:RM100,000

- 薪水增长:每年 2%

- 现有 EPF:RM300,000

- EPF 每月供款:23%

- 退休收入目标:最后薪水的 70%,约 RM100,000/年

根据计算器,她 55 岁时储蓄约 RM1.91M,但每年提取 RM100k 后,到 78 岁就会用完资金,仍有 10 年缺口。

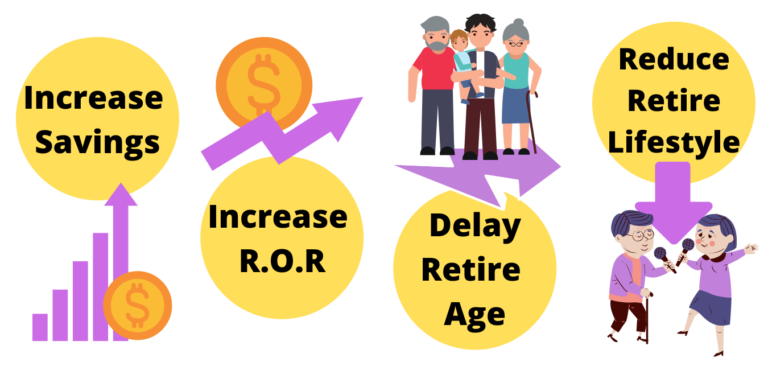

4. 如果退休资金不足的解决方案

- 延迟退休年龄:例如从 55 → 58 岁

- 提高储蓄比例:从 23% → 38%

- 提高投资回酬率:从 6.5% → 8.5%

- 降低退休生活水平:从 70% → 50%

5. 免费获取退休计算器

💡 想知道自己到底需要多少退休金吗? 👉 填写下方表格,我们会把 马来西亚退休计算器 (Excel) 直接发送到您的邮箱或 WhatsApp。

6. 马来西亚常见退休账户

- EPF 雇员公积金 – 马来西亚主要退休储蓄计划

- PRS 私人退休计划 – 自愿性长期储蓄,享有税务减免

- MIS 成员投资计划 – 允许 EPF 会员把部分存款转入核准的单位信托基金

The earlier you save, the easier it is to reach your goals.

This is because of compounding.

When you invest, your money earns returns.

If you reinvest those returns, they generate more growth.

Over time, compounding can create wealth far greater than your original savings. In addition, saving early reduces future stress.

1.1 Example of Starting Early

Here’s the difference between starting early and delaying retirement savings by 10 years:

At age 25: RM 210,000 → RM 683,481

If you start at 35: RM 210,000 → RM 262,059

For someone starting at 45: RM 90,000 → RM 77,328

That’s more than RM 420,000 difference between starting at 25 vs 35. As a result, delaying can cost you more than RM 420,000.

1.2 How Compounding Grows Your Money

For example, starting at age 25 could grow RM 210,000 to RM 683,481 by age 60.

However, if you wait until 35, the same capital may only reach RM 262,059.

As a result, you would miss out on over RM 420,000. Therefore, compounding rewards long-term investors.The later you start, the more compounding returns you lose, and the higher the percentage of income you’ll need to save later just to catch up.

When it comes to Retirement Planning Malaysia, starting early gives you a huge advantage.

2. How Much Do You Need for Retirement Planning in Malaysia?

A good rule is to aim for 70%–80% of your last annual salary in retirement.

For example, if your last salary is RM 100,000, you should plan for about RM 70,000–RM 80,000 per year after retirement.

👉 Want a more detailed guide?

Check out: How to Calculate Your Retirement Needs in Malaysia

3. Use a Retirement Calculator for Retirement Planning Malaysia

Not sure how much you need? Use our Malaysia Retirement Calculator (Excel) — designed with CFP Malaysia principles.

For example, you’ll only need to enter four simple details.

- Age

- Income

- Current savings

- Monthly contributions

It will then show you:

- How much your fund may grow

- How long could it last

- Whether you’ll face a shortfall and How to close the gap

👉 [Get Your FREE Malaysia Retirement Calculator (Excel)]

– Fill in your details, and we’ll send it to your email/WhatsApp.

Your details are safe with us. We only use them to send you the calculator.

🚀Send Me My Free Calculator / 索取免费退休计算机

“The question isn’t at what age I want to retire, it’s at what income.”

-George Foreman

3.1 Example: Retirement Planning for a 35-Year-Old Malaysian Lady

Assumptions:

- Assumptions:

- Age: 35 (plans to retire at 55)

- Life Expectancy: 88 years

- Annual Income: RM 100,000 (grows 2% yearly)

- Current EPF Balance: RM 300,000

- EPF Contribution: 23% of salary monthly

- Target Retirement Income: 70% of last salary (approx. RM 100,000 per year)

- Last Salary at 55: RM 142,826 (EPF contribution ≈ RM 32,850)

Her savings grow steadily and peak at RM 1.91M by age 55. However, with withdrawals of RM 100,000 a year, the funds run out by age 78. On the other hand, starting at 45 still gives some growth, but far less.As a result, she faces a 10-year shortfall before her expected lifespan of 88.

Her savings grow steadily and peak at RM 1.91 million by age 55. However, with annual withdrawals of about RM 100,000, the funds only last until age 78. On the other hand, starting at 45 still gives some growth, but far less. That leaves a 10-year shortfall before her life expectancy of 88. Therefore, additional planning is required to cover the 10-year gap.

4. Solutions if You Don’t Have Enough Retirement Savings

If your retirement savings are not enough, there are four practical solutions:

Delay Retirement Age — for example, retire at 58 instead of 55.

Increase Savings Rate — e.g., from 23% → 38%.

Boost Rate of Return (R.O.R.) — aim for 8.5% instead of 6.5%.

Reduce Retirement Lifestyle — adjust spending, e.g., 70% → 50% of salary.

In addition, combining two or more of these strategies may give you the best balance between lifestyle and financial security

📊 Illustration: Four strategies to close the retirement shortfall.

These strategies can help strengthen your Retirement Planning Malaysia plan if savings are not enough.

5. Get Your Free Malaysia Retirement Calculator (Excel)

💡Want to know exactly how much you need for retirement? In addition, this tool helps you see your retirement gap clearly before making decisions. Our free Excel tool is designed specifically for Retirement Planning Malaysia, following CFP standards.

👉 Fill in your details below, and we’ll send you the calculator directly.

🚀Send Me My Free Calculator / 索取免费退休计算机

Need a more tailored plan? Our consultant team can guide you with strategies designed for your goals.

6. Retirement Accounts in Malaysia

On the other hand, Malaysians also have formal retirement schemes to support their savings.

MIS (Member Investment Scheme): Lets EPF members invest part of Account 1 savings into approved unit trust funds for potentially higher returns.

EPF (Employees Provident Fund): The main scheme, with contributions from both employer and employee.

PRS (Private Retirement Scheme): A voluntary, long-term savings plan that offers tax benefits.

As a result, Malaysians have multiple options to secure their retirement.